🎯 500+ Traders earning profits with our strategies •🔥 Limited Time: Free Bonuses Worth ₹45,000+Stay tuned for new batch updates onInstagram!

🎯 500+ earning profits •🔥 ₹45,000+ Bonuses!Follow us onfor batch updates.

🎯 500+ Traders earning profits with our strategies •🔥 Limited Time: Free Bonuses Worth ₹45,000+Stay tuned for new batch updates onInstagram!

🎯 500+ earning profits •🔥 ₹45,000+ Bonuses!Follow us onfor batch updates.

Discover how 24 brokers meeting under a buttonwood tree in 1792 created the foundation for what would become the world's largest stock exchange—a story of trust, structure, and the birth of modern financial markets.

The New York Stock Exchange (NYSE) is known today as one of the most important financial markets in the world. But it had humble beginnings.

The story begins in New York City in 1792, when a small group of brokers and merchants made a simple agreement under a tree. This document—called the Buttonwood Agreement—laid the foundation for the NYSE.

In the late 1700s, after the American Revolution, there was growing trade in the new United States. People bought and sold government bonds, bank shares and other financial instruments.

But the system was informal. Brokers met in coffee houses, on street corners, and under trees—the rules were not clear.

Artistic rendering of the historic meeting under the buttonwood tree, May 17, 1792

📅 Date: May 17, 1792

📍 Location: Wall Street & Water Street, Lower Manhattan

👥 Participants: 24 brokers and merchants

On May 17, 1792, twenty-four brokers and merchants met in Lower Manhattan, at the corner of Wall Street and Water Street, near what was then under a "buttonwood" (sycamore) tree.

They signed a brief document that became known as the Buttonwood Agreement.

They agreed to trade exclusively among themselves (i.e., those who signed would prefer each other).

They set a standard minimum commission rate: one-quarter of one per cent (0.25%) on trades.

They agreed to bring order and trust into their business.

Though this was not yet a full formal exchange as we know today, it was the first time a group of traders committed to a shared set of standards and rules. This was a milestone.

The historic Buttonwood Agreement signed on May 17, 1792

After the Buttonwood Agreement:

The brokers soon moved from meeting under the tree to having a gathering place. They used the Tontine Coffee House on Wall & Water streets as one of their meeting places.

The group formalised their business into the "New York Stock & Exchange Board".

The name changed to the New York Stock Exchange (NYSE) as it is today.

These steps show how a simple pact grew into a structured marketplace, and then into a major stock exchange.

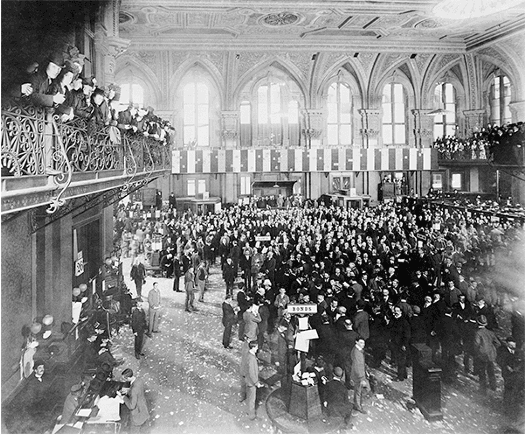

The bustling NYSE trading floor in the 19th century

Why is the Buttonwood Agreement and the formation of the NYSE important?

By setting rules, the brokers improved confidence in the marketplace.

With fixed minimum commissions and exclusivity among members, practices became more uniform.

Over time, more companies, more investors and more trades participated, helping the economy grow.

The NYSE became a model for how modern stock exchanges operate—organized, regulated, and centralised.

Date: May 17, 1792

Location: Outside 68 Wall Street (or near the corner of Wall & Water Streets) under a buttonwood (sycamore) tree

Number of signers: 24 brokers/merchants

Minimum commission agreed: 0.25% (one quarter of one per cent)

Evolution: Agreement → trading gathering → 1817 Board → 1863 NYSE

What began under a tree in Lower Manhattan has grown into one of the largest stock exchanges in the world.

The Buttonwood Agreement may seem modest—a document signed by 24 men setting simple rules—but its influence was powerful. It marked the shift from informal, unregulated trading to the structured, regulated markets we know today.

Understanding this origin helps us appreciate how markets evolved, how trust and rules matter, and how big institutions often start with simple ideas.